MTP Ventures: 2021 Review

December 1, 2021

Analyst Team

We reflect on our 2021 activity, offer a view on the three sectors that caught our eye in the trailing twelve months, and pick three trends to watch heading into 2022.

2021 in review

2021 has been a strong year for MTP Ventures. The year opened with our Q1 Showcase, presenting Mocono, a cloud software platform that allows media owners to introduce paywalling to their digital properties. After a nine month incubation period, Mocono closed their seed round oversubscribed and have since been in MVP development, due to launch within a few months.

Our Q2 Showcase presented Mellow Pages, an online strain database and cannabis community platform. Since the raise, Milk & Amber, the leading marketing and business growth organisation for the cannabis

industry, have joined as content partners, forming the backbone of the Mellow Pages content production engine. Mellow Pages is on track to launch in Q1 2022, with a subsequent Seed B round planned for Q2 to fuel the next stage of marketing and user aggregation.

From a wider market perspective, global venture investment is projected to reach a record high of USD 580bn for FY21 and has been the highest performing asset class globally since 2018. The long-standing concentration of venture activity, in terms of value, in North America is beginning to dissipate. Investors are transitioning to Europe and the UK as lucrative investment destinations, with UK start-ups receiving USD 19.6bn in funding across 1,256 VC deals as of 9M2021.

This uptick in investor interest is accompanied by a changing tide in VCs’ offering, differentiating from the traditional invest-and advise model, and providing tangible value to founders.

Looking ahead to 2022, MTP Ventures will continue to partner with founders and business owners to build, fund, and grow extraordinary ventures underpinned by world class technology.

2021 has been another unusual year and the world has continued to be gripped by the effects of COVID-19. This has not stunted business innovation, however, and we have seen both the continued progression of outstanding sectors, but also the emergence of others. We look at three that have caught the eye in the trailing twelve months.

The Rear View Mirror

Cannabis

The North American cannabis industry has sustained its growth over the course of 2021. The US market is anticipated to see USD 25bn in legal cannabis sales by FY2021, resulting from continued state legalisations, whilst the size of the Canadian cannabis market grew to USD 4.1bn.

Similarly, growing political interest in Europe, with Luxembourg legalising the recreational use and personal growth of cannabis, and Germany’s newly elected coalition pledging to review cannabis legislation, sees the cannabis market poised for growth on this side of the Atlantic.

The legalisations seen in 2021, alongside the growing public discourse surrounding the legality of cannabis, promises an opportunity for value creation up and down the supply chain.

The universe of regulations imposed on cannabis companies stresses the importance of compliance. Digital analytics tools for the evaluation of crop, and THC levels, as well as packaging data, and supply tracking technologies, can all assist with the compliance requirements of the cultivation process.

From cannabis-focused social media and data aggregation plays, such as our Mellow Pages platform, and dispensary delivery mobile apps, such as Snoop Dogg’s Dutchie and Eaze, to seed-to-sale barcoding technologies, we see the bulk of digital opportunities resident in the wider ecosystem of non-plant activities that are ancillary to cultivation.

As of November 2021, the cryptocurrency market was worth USD 2.7trn[6]. Bitcoin and Ethereum, the two most notable coins in the market, both experienced growth as a result of continued retail interest. Bitcoin’s market cap increased by 80% between January and November 2021 to USD 1.1trn, whilst Ethereum more than quadrupled its market cap in the same period, to USD 527.3bn.

These increases in value come on the back of an uptick in retail investor interest, enabled by ease of access to the market, and driven by the dominance of crypto discourse on social media. In October, Twitter announced its tipping function, allowing users to pay creators for their content in Bitcoin.

Whilst there has been a surge in retail interest in the crypto market, institutional investors have also begun to take notice. The ProShares Bitcoin Strategy ETF, the first ETF of its kind, launched on the New York Stock Exchange in October. The fund closed 4.7% higher on the day and ended with assets of USD 570mn, making it the second most heavily traded new ETF on record. As of September, 23% of family offices had cryptocurrency in their portfolio and major companies, such as magazine publisher, Time, have begun adding cryptocurrencies to their balance sheets.

Non-fungible tokens (NFTs) began to emerge in the investing public’s consciousness in the early months of the calendar year, with Beeple’s Crossroads selling for USD 6.6mn. A month later, Beeple, perhaps the most popular NFT artist, sold his Everydays piece for USD 69.3mn – an NFT record. An NFT is a unique piece of data, usually presented as easily-reproducible items, such as art, that uses blockchain technology to administer proof of ownership to the unique file. Over 2021, NFTs have become increasingly popular, with celebrities and sports teams alike releasing their own exclusive tokens. NFT sales volumes grew to USD 10.7bn in Q32021.

We anticipate a gradual tapering of the hype surrounding NFTs, especially digital artwork, across the first half of the new year. The underlying concept of NFTs, however, will persist. The proof of ownership model can be used to democratise access to artwork, protection of creators’ royalty rights, and the proof of authenticity of other assets, both digital and analogue. As an example, Louis Vuitton established its own authenticity blockchain, Aura, in 2019; reducing the profitability of the counterfeit market.

Workplace Transformation

The COVID-19 pandemic, and work-from-home Government mandates, have catalysed the pre-existing trend of distributed workforces. Organisations were forced to adjust overnight to their workforce operating from a distance and the problems this caused for team communication, collective group work, and file access.

Much of 2020’s activity was reactionary, but the pandemic exposed weaknesses in many companies’ distributed systems. Alongside this, as countries emerge from the pandemic, employees are demanding more favourable working conditions, preferring to split their working time between the office and home, the as yet uncertain implications of the Omicron variant notwithstanding.

2021 has seen an increase in investment into digital workplaces, that enable new, and more effective, methods of distributed working and raising employee engagement. As such, the digital workplace market is projected to grow at CAGR 21.3% to USD 33.4bn by 2022, up from USD 22.7bn in 2020, and to USD 72.2bn by 2026. Similarly, cloud computing services and SaaS tools are in demand, to aid with the support of a distributed workforce, and cost-effective expansion. The optimisation of a company’s distributed performance through cloud migrations is labour- and cost intensive. Our view is that, in the age of continued globalisation, all new businesses will be born in the cloud. As such, there is significant market opportunity for development services supporting cloud native and SaaS platforms.

2022 is a promising year for venture investment, despite that, at the time of publishing, the severity of the impact of the new-found Omicron variant is yet to be determined. We pick three trends to watch going into the new year.

Travel Technology

The global travel market is poised to return to pre-pandemic valuations by 2023, and is projected to grow at CAGR 11% to USD 909bn by 2025. As they emerge from the COVID crisis, travel companies will need to strengthen their offer to add value to the tourist experience, incentivise demand, and leverage technology to increase revenue and expand EBITDA.

In recent years the travel industry has undergone increasing digitalisation. The number of bricks and mortar retail travel agent locations across the UK has continued to decline and is 21% lower than in 2016, tangibly illustrating the migration to online and digital solutions. As of 2020, 31% of UK-outbound tourists booked hotels online, and, in 2019, the top three global online travel agents (OTAs), Booking.com, Expedia and AirBnB, realised an average revenue of USD 11bn.

The OTA market is the obvious destination for capital, although it is saturated and already dominated by a small number of large organisations. Our house view, therefore, is that digital solutions, such as white label, customisable, booking and concierge applications or conversational AI bot systems, are spaces to watch. These solutions are positioned to tap into the sustained digitalisation of the industry, assist retail travel agents with the curation of a much-needed online presence, and add value to destination and travel companies’ end users.

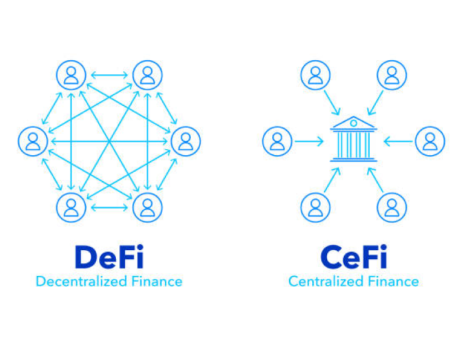

Decentralised Finance

Decentralised Finance, or DeFi, projects, such as Aave, Avalanche, Cardano, and Chainlink use blockchain technology, and automated smart contracts, to remove the bureaucracy and middlemen usually found in traditional financial services, such as lending and trading.

Transaction fees and the influence of large corporations are minimised; democratising access and increasing affordability. As of November 2021, transaction volumes on DeFi protocols had reached USD 300bn per month; illustrating the value of the market.

We acknowledge the thesis that distributed ledger technology will supplant traditional finance and fiat currency. We see the legacy and challenger forms of finance learning to coexist and adapt to each other’s presence out of necessity in the near term.

We view the proliferation of retail NFTs as a necessary first wave, and expect a residual opportunity set to emerge around the underlying rails, or infrastructure, that support the cryptocurrency eco-system. Platforms, such as the aforementioned Aave and Coinbase, which facilitate the lending and trading of coins, serve as examples of this infrastructure. Paradigm One and Andreessen Horowitz, amongst others, have both raised billion dollar funds aimed exclusively at expanding the ecosystem of token based applications and DeFi protocols. In 2021, seventy-two DeFi protocol start-ups were backed by investors globally, a 25% increase from 2020; this trend is anticipated to continue at pace into 2022.

Web 3.0 is the next phase in the world wide web’s evolution. Web 1.0 was ‘read-only’, with static pages and no user interaction. Web 2.0, the current, participative web, allows users to interact with one another.

Web 3.0 will be immersive and composed of decentralised applications that run on blockchain technology and utilise smart contracts. The ability of web 3.0 to process information, operate machine learning, and write smart contracts will allow full automation of any activity usually conducted on the internet.

Similarly, the metaverse, a visual representation of the internet and a component of web 3.0, blurs the lines between reality and digitality, with users’ avatars acting out their reality-based internet activity in a digital universe.

Web 3.0

Web 3.0 is still in its infancy, but the growth in popularity of decentralised autonomous organisations, or DAO, suggest that elements of web 3.0 are certain in the near future. A DAO’s decentralisation redefines corporate ownership. Each participant is issued an ownership contract and receives a token to mark their stake in the DAO. One principle of DAO is the transparency of governance, so each token holder has voting power in strategic decision making processes.

As a DAO is founded on blockchain technology, smart contracts can be used to automate business operations. The capabilities of a DAO, at least to the degree of full automation of business, are currently limited. An interesting concept currently gaining traction, however, is the use of DAO as a form of a democratic venture fund. The established DAO is used to pool the crypto assets of its members, and each member has an equal vote on where those assets should be invested. Web 3.0 is still an embryonic concept, but the universe of potential applications continues to expand. We are excited by the space.

Green Tech

After a positive, but somewhat underwhelming, COP26, climate focused goals are now at the forefront of global government agendas. Similarly, business leaders and investment managers are beginning to realise the vast cost, but also profitability, of what lies ahead. A UNFCCC report disclosed that USD 125trn is needed in climate investment to meet net-zero and avert the climate crisis by 2050, illustrating the opportunity for innovative climate-focused enterprise.

Whilst the majority of investment will be channelled into the energy transition and large scale technology projects, such as EV charging networks and sustainable air travel, we see a market opportunity for digital green start-ups offering mobile and web solutions to consumers and producers globally. This market is currently emergent, but gamification solutions, such as Zero Carbon, an app that allows users to

compete on lowering their footprint and to conduct offset payments for carbon intensive activities, or Flora, which allows the user to plant real-world trees, are illustrations of the opportunity.